Market Size

As of 2020, the major trend areas underlying the NFT market are arts, collectibles, metaverse, sports, games and utilities, etc.

| “Metaverse” to see Explosive Growth in the Future

Global leaders Microsoft and Nvidia declared 'Metaverse' as the next-generation core business and introduced new technologies related to Metaverse. Nvidia CEO Jensen Huang said, "I am confident that the Metaverse will become a new economy that is bigger than the current one." Prior to this, in October, Facebook, the world's largest social media group, changed its name to 'Meta' after 17 years of its founding, and Mark Zuckerberg, Meta CEO, said, "Metaverse is the next step in the Internet. I hope that as time goes by, we will be recognized as a metaverse company.”

The Metaverse war between global big tech companies has begun in earnest. The Wall Street Journal reported that “a big tech war is raging over the metaverse, reflecting a growing belief that the metaverse creates substantial wealth in the real world.” Metaverse is a compound word of “meta” meaning transcendence and virtuality and “universe” meaning the real world, and refers to a virtual world that is linked with reality. In addition, interest in the virtual world and demand for metaverse technology have rapidly increased as non-face-to-face society has become routine due to the novel coronavirus pandemic.

As it is in its infancy, Metaverse market size forecasts vary widely by research institute. Bloomberg Intelligence predicts that the Metaverse market will grow from US$478.7 billion in 2020 to US$783.3 billion in 2024. Morgan Stanley said, “Metaverse will be the next-generation social media, streaming, and game platform,” and suggested the size of the future market for Metaverse at up to US$8 trillion. Big tech companies are jumping in to preempt the Metaverse ecosystem, which is expected to be worth as little as US$800 billion or as much as US$8 trillion, but there are big differences in their philosophy and strategy for looking at the Metaverse.

| Augmented Reality (AR), Virtual Reality (VR), Extended Reality (XR), 5th-gen communication (5G), etc. Re-Imagination and Technological Development

With the growth of the Metaverse-based virtual reality market, the AR/VR market is projected to grow from US$46.4 billion in 2019 to US$476.4 billion in 2025 and US$1.5 trillion in 2030, according to Price Waterhouse Coopers.

The core of the Metaverse is the expansion of the digital world, and there are more things that can be done online or in a digital environment, and it can be replaced with a digital environment without having to do it in real life based on the technological infrastructure that will develop more and more. This is a Metaverse with a wider frame of activities and functions that could not be done in the virtual world in the past, and what is currently attracting attention is that economic activities, performances, and social gatherings, which were considered to be unique areas of reality, can communicate and interact in the virtual world as well.

The Acceleration Studies Foundation, a technology research organization that studies Metaverse, divides it into four major types according to implementation space and handling information.

1. Augmented Reality (AR)

The virtual world is added by overlaying the real world with CG or audiovisual devices. The goal is to enhance the senses that are difficult to receive in reality, and the real world is realized by superimposing virtual information on the real space.

2. Life-logging

It includes the world in which daily experiences and information are recorded or stored, such as SNS and vlogs, in a form in which information that an individual is active in real life is connected to and integrated into.

3. Mirror Worlds

It is a virtual representation of the real world with a structure in which external environmental information is integrated into a virtual space.

4. Virtual Worlds

A virtual world with a complete structure that operates independently of reality is implemented so that you can enjoy a second lifestyle.

|The Size of the Global NFT Market

Bitcoin announced in 2008 that introduced and popularized blockchain technology to the world, but it started with Ethereum in 2015, that opened the era of full-scale blockchain. By adopting Turing-complete smart contract technology, Ethereum shows new possibilities in the blockchain, which has remained as a means of storage of value. It opened up an environment of explosive growth with a new decentralized ecosystem called functional tokens, DApps (Decentralized App), and ICOs.

In addition, even if there is no third-party intermediary such as a bank, anyone can make reliable and secure transactions using blockchain technology. Blockchain can be used not only for cryptocurrency, but for all data processing that has online transaction history and requires history management. Blockchain can be used in a variety of ways, such as smart contracts, logistics, document management, medical information, copyright, social media, game item management, electronic voting, and identity verification systems. In addition, blockchain is one of the core technologies of the 4th industrial revolution, and among them, digital assets and businesses using them are attracting attention, and at the same time, digital asset platform business has become the most popular field.

NFT (Non-fungible Token) is a technology that uses blockchain technology to give unique marks to digital content. Numerous digital artworks can be copied over the Internet. However, there is only one digital work to which NFT technology is applied. That makes the NFT acts as an original certificate. For example, there are many fake Van Gogh paintings in the world, but the real one is one. NFT technology can prove its originality.

From the perspective of all original authors, there is a route and opportunity to sell their work. By applying NFT technology, all digital assets, such as paintings of popular or unpopular artists, famous photos and digital images, and artist's sound sources, can be sold by transparently proving their value. NFTs are paid a certain amount of commission each time they are sold or the owner changes. The higher the popularity and scarcity value, the higher the income.

Users who purchase NFTs can also raise funding as a means to support their favorite artists. In addition, when you purchase NFT, you are guaranteed the basic right to publish the image online or use it in your profile. This gives the expectation that the NFT itself will be recognized for its investment value as an asset and will benefit from an increase in the value of the asset in the future.

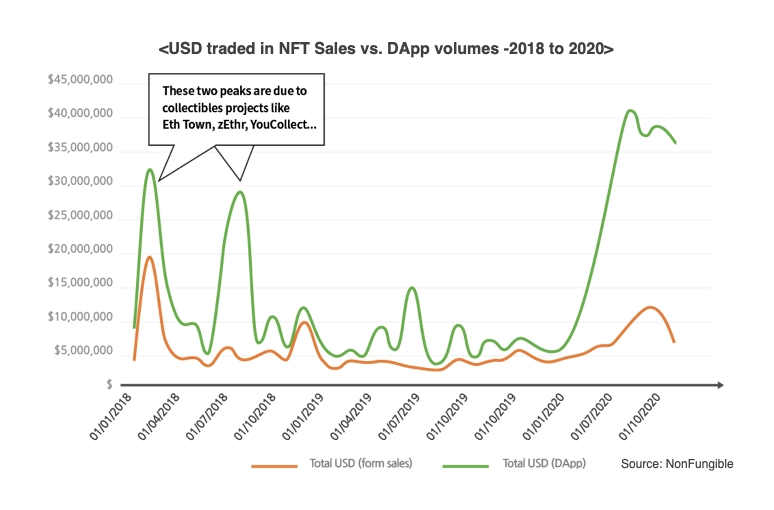

In this non-fungible token (NFT) market, the size of the NFT market grew more than fourfold in 2020 compared to the previous year, and a total of $250 million in transactions was issued in the NFT market in 2020. The total number of active wallets that owned or traded NFTs also increased significantly, and the number of NFT-activated wallets nearly doubled from 112,731 in 2019 to 222,179 last year.

A total of $250 million worth of transactions occurred in the NFT market in 2020

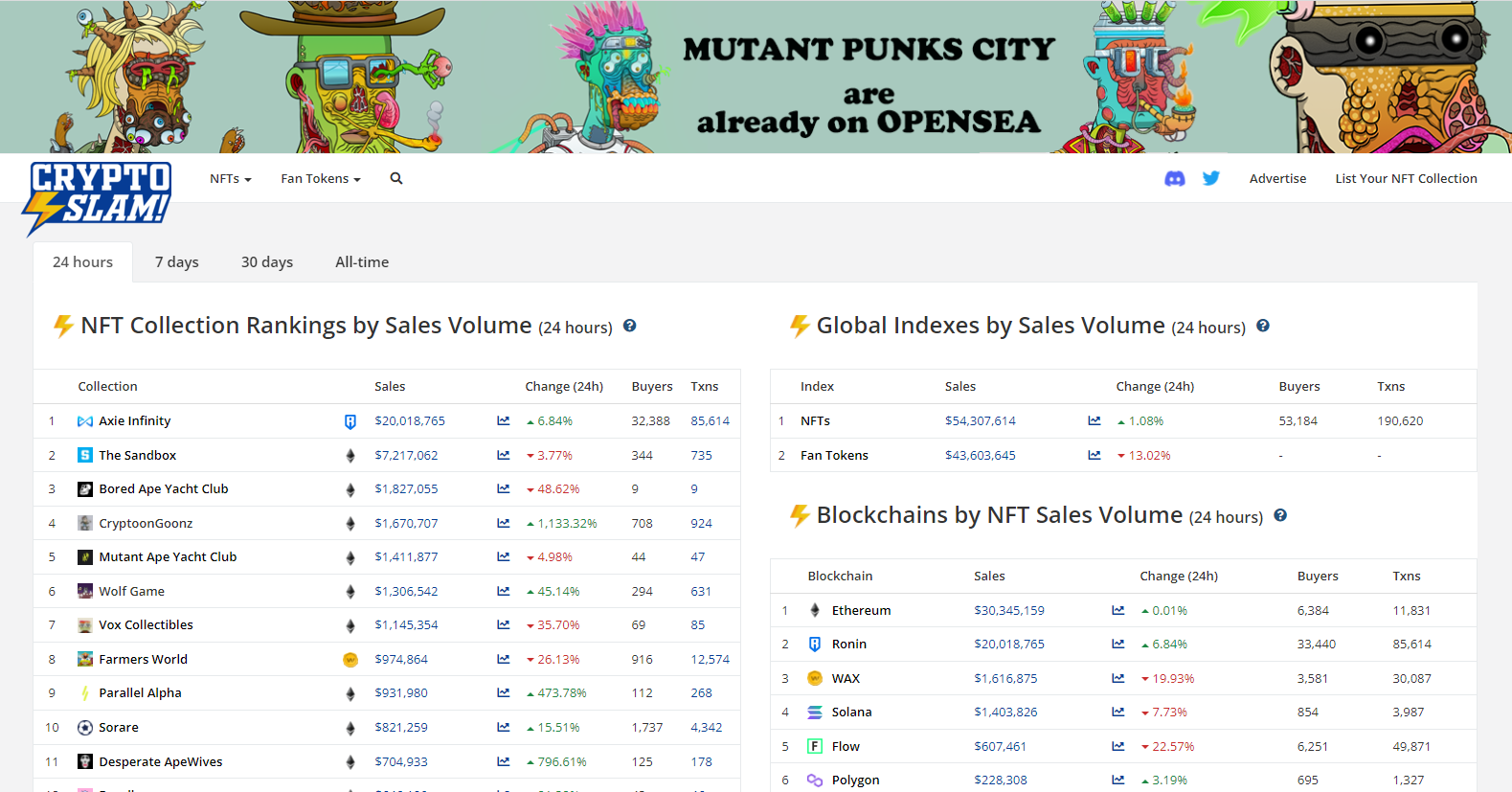

Globally, the NFT industry is developing rapidly, and major global companies are rapidly accessing the NFT industry. In the video game market, Ubisoft, Mythical Games, Capcom, SquareEnix, Atari, etc. participate, and in the sports market, NBA, MLB, Formula 1, PSG, FC Bayen München, Real Madrid & more than 100 football are conducting business. In the fashion sector, Nike is the representative, and in the entertainment sector, there are BBC Studios, Warner Music, Paramount Pictures, etc.In the field of technology infrastructure, there are Samsung, IBM, AMD, Microsoft Azure, etc., and in the field of art and auction, Christie's, Sotheby's, deadmau5, Lil Yachty, etc. are rapidly expanding.

The non-fungible token (NFT) market is expanding in these various fields, but the collection part is gradually decreasing based on the sales revenue of the current NFT market, and the ART part is rising with the second largest number of users and active transactions. Following, the game industry is still popular as a beneficiary of the pandemic.

Recently, NBA Top Shot, an NFT card using representative intellectual property (IP), surpassed Crypto Kitty to record a cumulative transaction volume of $29.42 million. Although the number of users collecting NBA Topshots is only about 18,000, which is 20% of Crypto Kitties, the large transaction volume per person proves the value of NFT.

Besides, in the NFT world, various digital creations are traded at high prices. A painting of a cat (NYAN CAT) sold for $580,000, and digital pixel art (pointillism) called Cryptopunk sold for $7.5 million. Twitter CEO Jack Dorsey auctioned off his first tweet, “just setting up my twitter,” in May 2006, and as of the 16th, the value of his tweet has risen to $2.5 million (about 2.8 billion won).

According to the Global Art Market Report 2020 published by UBS, a global financial company, the global art market in 2019 is worth about 76 trillion won, of which the online sales market is about 7 trillion won. In addition to the online art market, the total transaction value of NFT-based art works in December 2020 was $8.21 million (about 8.87 billion won), more than three times higher than in November, recording an all-time high.

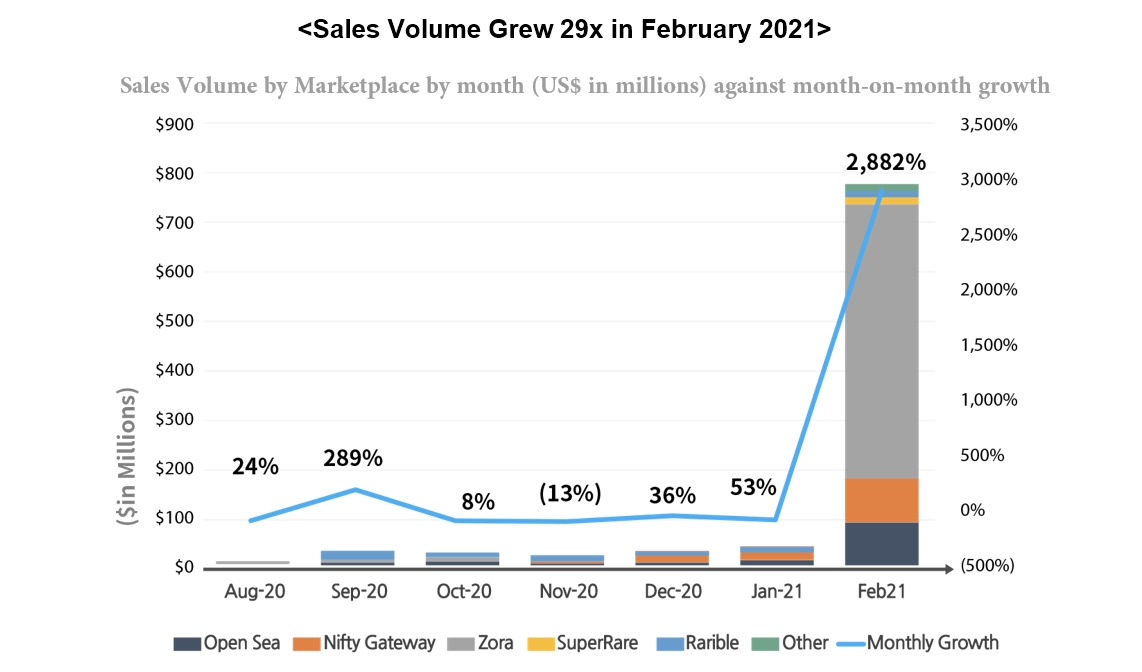

As such, as the global Coronavirus pandemic disrupted the operation of museums and art galleries, sales of physical works plummeted last year, but sales of NFT-based works reached an all-time high. While being applied to these various industrial fields, the transaction volume of NFT-related industries in 2021 will increase by 29 times in one month, and the value of the NFT market has been verified once again.

Last updated